Why is there a disparity between my reporting sources?

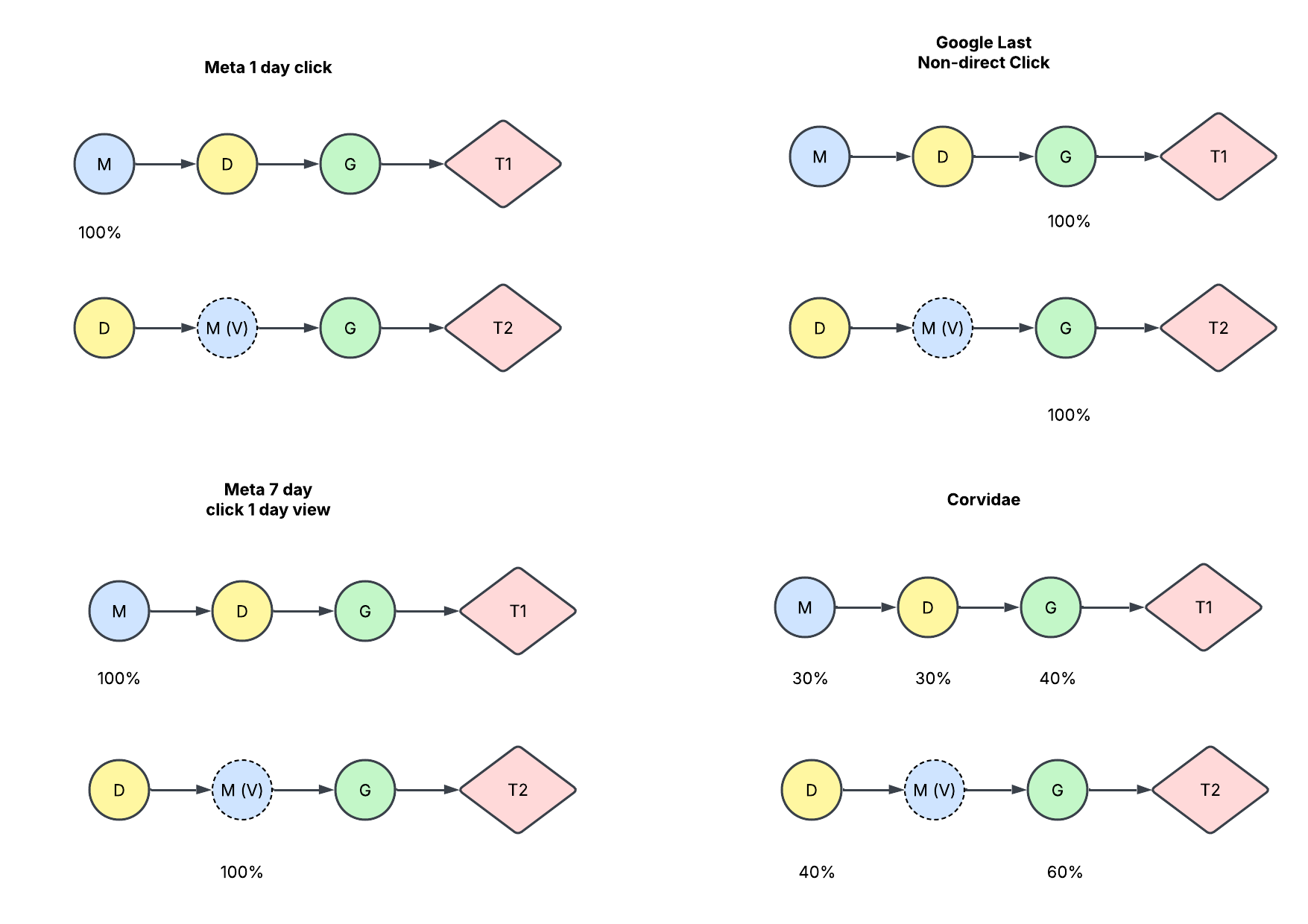

Both Meta and Google have attribution models available for their advertising platforms. However these models can lead to inconsistent results. Let's consider two transaction paths.

In the first, the customer clicks though a Meta ad to a client website, then later the same customer clicks through a display ad to the website, then finally they visit via a Google search advert and perform transaction 1. In this case both Google and Meta will claim 100% of the revenue was due to their advertisement leading to a 100% overclaim before we even consider what credit should be given to the display advert. By contrast the Corvidae model will split the revenue attribution across the three channels in proportions weighted by the model but adding up to 100% overall, indicative values are shown in the diagram.

In the second case the customer visits the website via a display ad, Meta then displays an advert (a view), but the customer does not interact with it, and finally Google displays an advert leading to transaction 2. In this case once again Google’s default model claims 100% of the revenue, as does Meta if you use their 7 day click 1 day view model. By contrast the Corvidae model will split the revenue attribution between display and Google in proportions weighted by the model but adding up to 100% overall.

In short both Google and Meta have picked models which are likely to favour their offerings. Google concentrates on the end of the customer journey when customers are more likely to be conducting tailored searches. Meta are even more egregious with their models claiming 100% of the revenue if any of their adverts are involved in the path. In some of Meta’s models they claim even if the adverts they displayed did not lead to a visit to the client website. This means that taken together their models tend to overclaim credit for transactions, in some cases their combined claims can exceed total revenue.

Corvidae does things differently, considering the whole path and not playing favourites but rather trying to attribute credit as accurately as possible between all channels in a transaction’s path.